各位奔波在CFA考试冲刺第一线的筒子们,你们最近过得还好吗?在《欢乐颂》热播的时下,可不能分心刷剧哟。如果想成为投行精英安迪那样的金融佼佼者,可要抓紧最后的时刻,磨刀奋战即将到来的六月CFA特许金融分析师考试! CFA协会明确表示,每一位CFA考生都需要至少300个小时准备考试。如果你已经对CFA考试有了完全的准备,如何检验自己的考试成果呢?根据高顿财经研究院CFA考试研究发现,以下八道题目就可检测考生的CFA掌握水平。许多投行精英们都认为这八道题目非常棘手,堪称CFA一二三级中,遇到的“最难”题,快来看看你是否会解!

CFA一级试题: 1. Beth Knight, CFA, and David Royal, CFA, are independently analyzing the value of Bishop, Inc. stock. Bishop paid a dividend of $1 last year. Knight expects the dividend to grow by 10% in each of the next three years, after which it will grow at a constant rate of 4% per year. Royal also expects a temporary growth rate of 10% followed by a constant growth rate of 4%, but he expects the supernormal growth to last for only two years. Knight estimates that the required return on Bishop stock is 9%, but Royal believes the required return is 10%. Royal’s valuation of Bishop stock is approximately: A. $5 less than Knight’s valuation B. Equal to Knights valuation C. $5 greater than Knights valuation 卡普兰教授:Tim Smaby 解析: The correct answer is A. You can select the correct answer without calculating the share values. Royal is using a shorter period of supernormal growth and a higher required rate of return on the stock. Both of these factors will contribute to a lower value using the multistage DDM.

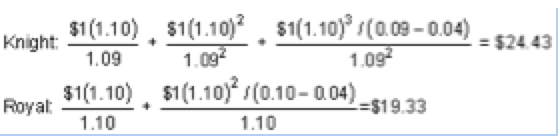

Screen Shot 2015-05-22 at 11.36.52 Royal’s valuation is $5.10 less that Knight’s valuation.” 2. John Gray, CFA and Sally Miller are discussing what they think their year-end bonus will be and how they might spend them. Miller is new to working in finance and asks Gray what people usually get and what he has got in the past. Gray explains that the firm prohibits employees from discussing their exact bonus number but also says that 30% of people get ‘good’ bonus’, 50% ‘average’ and 20% ‘low’. Gray says that he really wants a new smart watch recently released by a large tech company and says that he will definitely buy it if he gets a ‘good’ bonus, while there is only a 50% and 10% probability he will get it with an ‘average’ or ‘low’ bonus respectively. Two weeks later, Miller sees Gray in the office and asks him if he got a good bonus. Gray reminds Miller that the firm’s policy means he cannot say,天剑狂刀页游公益服, but Miller notices that he is wearing the new smart watch they were talking about. Miller goes back to her desk and calculates the probability that Gray got a ‘good’ bonus is closest to: A: 30% B: 53% C: 57% 知名投行培训主管Nicholas Blain 解析: “Using Bayes’ Formula : P(Event|Information) = P(Event) * P(Information |Event) / P(Information) In this case, the event is getting a good bonus, and the information is that Gray has bought the new watch. The probability that he got a good bonus and then bought the watch is given by: P(Event)*P(Information |Event) = 0.3*1.00 = 0.30 The total probability that he would buy the watch is given by: P(Information) = 0.3*1.00 + 0.5*0.50 + 0.2*0.10 = 0.57 Therefore, the probability that he got a good bonus is the proportion of probability that he got a good bonus and got the watch, to the total probability he got the watch: P(Event|Information) = 0.30 / 0.57 = 0.53.” 3. For a European Call option on a stock, which of the following changes, (looking at each change individually and keeping all other factors constant) would an analyst be least likely confident about an up or down movement in the price of the option? A: Share price goes up; dividend goes up B: The demand for share increases / supply decreases; interest rates fall C: Share increases in volatility; the firm cancels the next dividend 知名投行培训主管Nicholas Blain 解析: “Share price up = Option Price Up Dividend up = Option Price Down (dividends are benefits of holding the underlying share, when holding the option, you do not receive dividend) Share in High Demand = Option Price down as this is a benefit in holding the underlying Interest Rates Fall = Option Price Down as this reduces the cost of carry of holding the underlying Share increases in volatility = Option Price Up Cancels next dividend = Option Price Up, as these dividends are not received by the option holder anyway A is the correct answer; as the increase in the option price due to the share going up could be offset by the decrease in the price due to the dividend going up. B results in the option price falling for both scenarios and C results in the option price rising in both scenarios.” CFA二级试题: |